On August 6, 2025, Western Midstream Partners (WES) announced a $2 billion transaction to acquire Aris Water Solutions (ARIS).

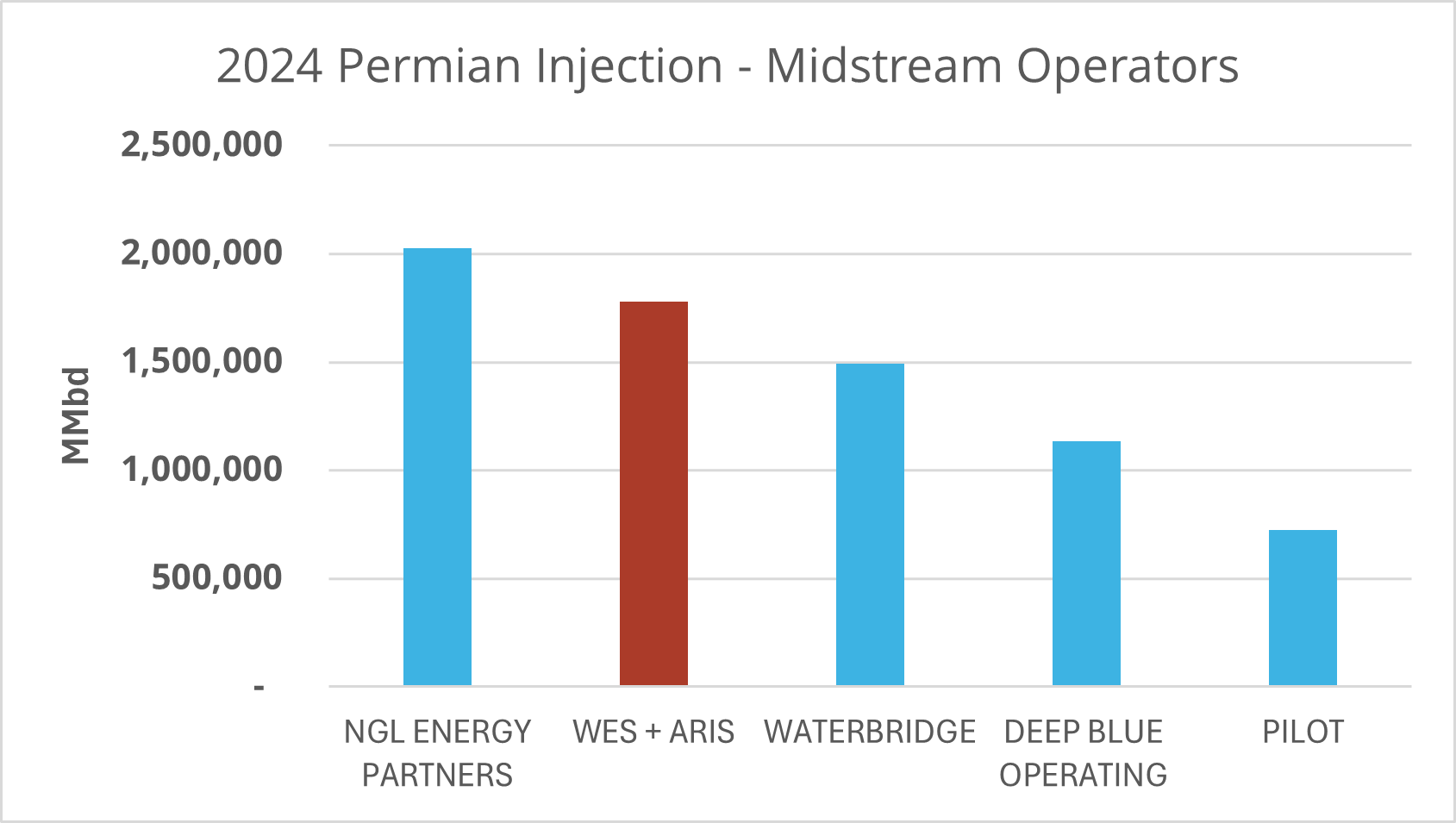

The deal — structured as a mix of equity and cash — brings together two of the top five produced-water midstream operators in the Permian Basin and the combined company is now the 2nd largest water midstream operator in the basin. From a market perspective, this combination changes the competitive dynamics in meaningful ways.

From a B3 Insight perspective, it also reinforces the value of having accurate, basin-wide data to measure, benchmark, and anticipate shifts in market structure.

According to B3 Insight data, what this means for the market:

-

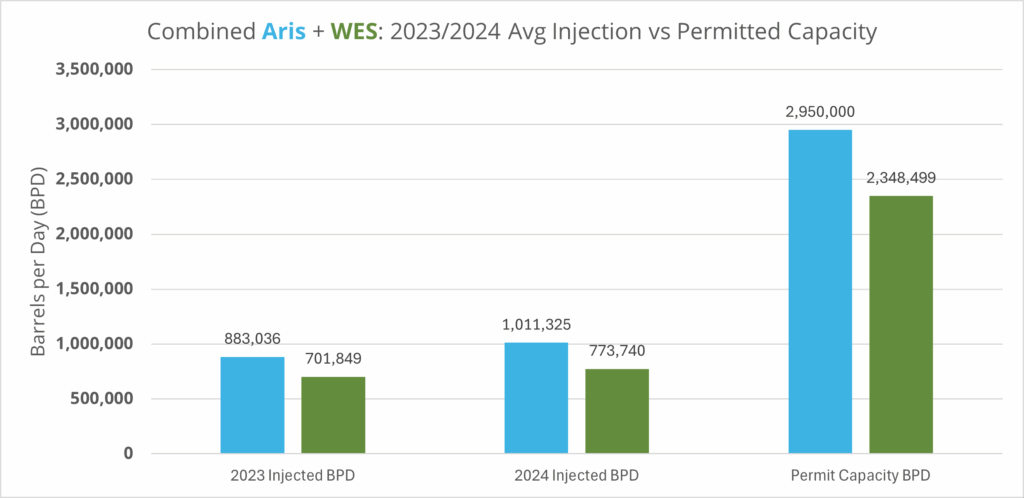

Scale: 198 SWD Permits, ~5.3M Bbl/d permitted capacity; 128 Drilled and Completed SWDs

-

Integration: Gathering, disposal, recycling, beneficial reuse, long-haul transport (Pathfinder)

-

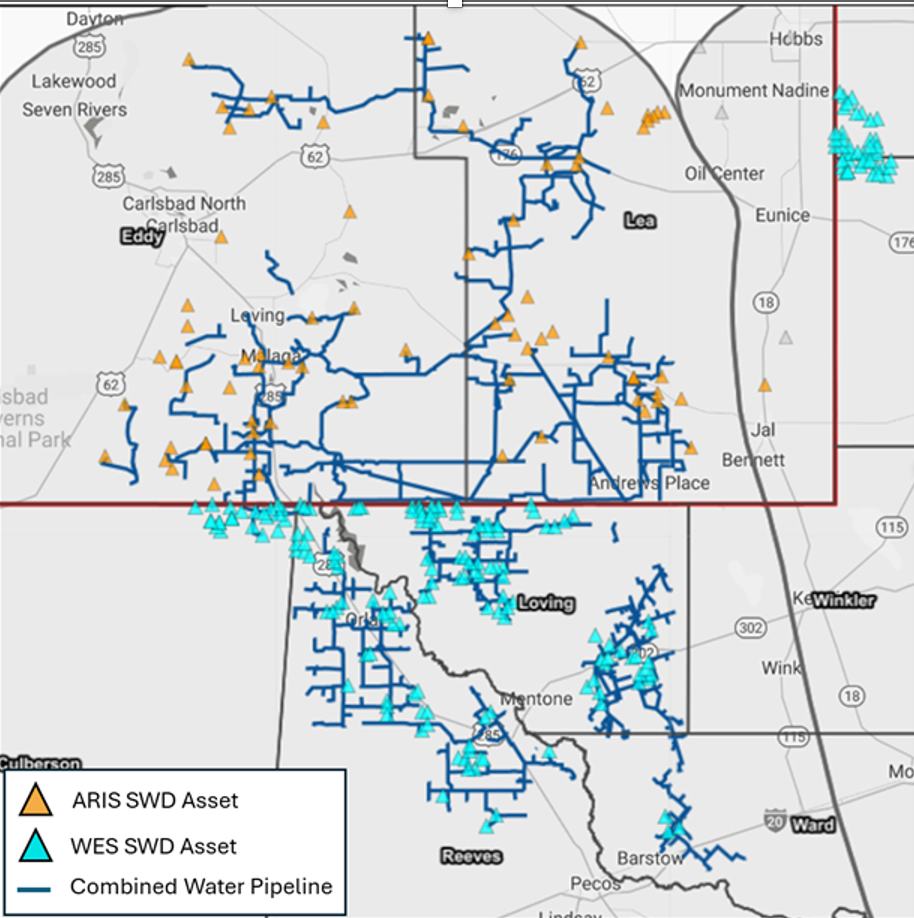

Geographic reach: Significant New Mexico expansion into Lea & Eddy counties

-

Customer diversification: Long-term, investment-grade contracts

-

Upside: Over 5 million Bbl/d of unused capacity for future growth

In the Permian water midstream space, scale + capacity = opportunity. This deal positions WES to capture a larger share of the market for years to come.

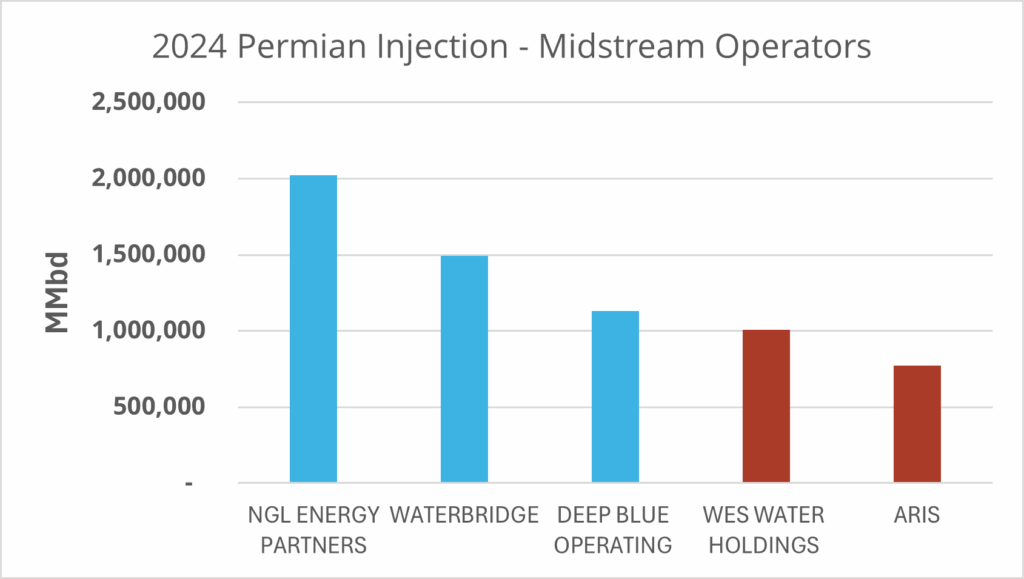

B3 Insight data – Pre-acquisition: WES ranked 4th, Aris ranked 5th in 2024 average daily Permian water injection.

Post-acquisition: The combined WES + Aris leap to ~1.78 million Bbl/d, overtaking WaterBridge and Deep Blue to become the #2 water midstream operator in the basin.

This transaction expands scale while signaling a shift in competitive dynamics.

The newly formed entity strengthens its foothold in Lea and Eddy counties in New Mexico, provides enhanced ability to compete for multi-service midstream contracts (gas, crude, NGLs, and water), and has future upside from the McNeill Ranch pore space and beneficial reuse/desalination technologies.

Growth potential: B3 data shows the combined system averaged 1.58 million Bbl/d in 2023 and 1.78 million Bbl/d in 2024 — against a permitted capacity of ~5.3 million Bbl/d

Importantly, it underscores a broader industry trend: water has become a critical axis of operational continuity, risk management, and capital strategy.

At B3 Insight, we continuously track the real-world performance of every water midstream system across the Permian. The Western-Aris deal establishes a new benchmark for scale, integration, and competitive positioning in produced water infrastructure.

To learn more about recent trends and activity, subscribe our 2025 Permian Water Market Trends and Forecast Report.