By David Hicks

Just a 5.67… Where does your company rank when it comes to managing water? How are you doing compared to others in your region or in your industry? What value does ranking highly on a water management index really bring to your company? A higher rank has the potential to inform better operational economics and result in higher Environmental, Social, and Governance (ESG) ratings for capital investments. Water management and associated risks to assets will increasingly impact your business and the time to know where you rank is here.

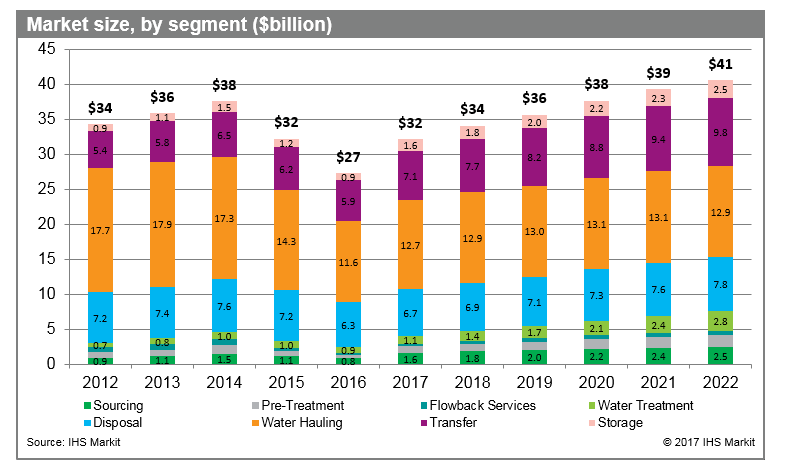

By 2025, it is estimated that $145 trillion in assets – $41 billion of which pertain to water management in oil and gas (see below Market size, by segment) – are expected to be exposed to water management risks in the next four years. The way we handle water in the oil and gas sector is more important than ever and companies that demonstrate results with tangible and comprehensive data will stand out among peers and maximize business value.

Water production and waste management in the oilfield has historically been a secondary concern compared to oil and gas production and transportation issues, although it is a key component for successful energy companies. There is hardly an aspect of the oil and gas industry that water risk does not impact – financial, environmental, operational, reputational – and increasing investor concerns make transparency and benchmarking important business.

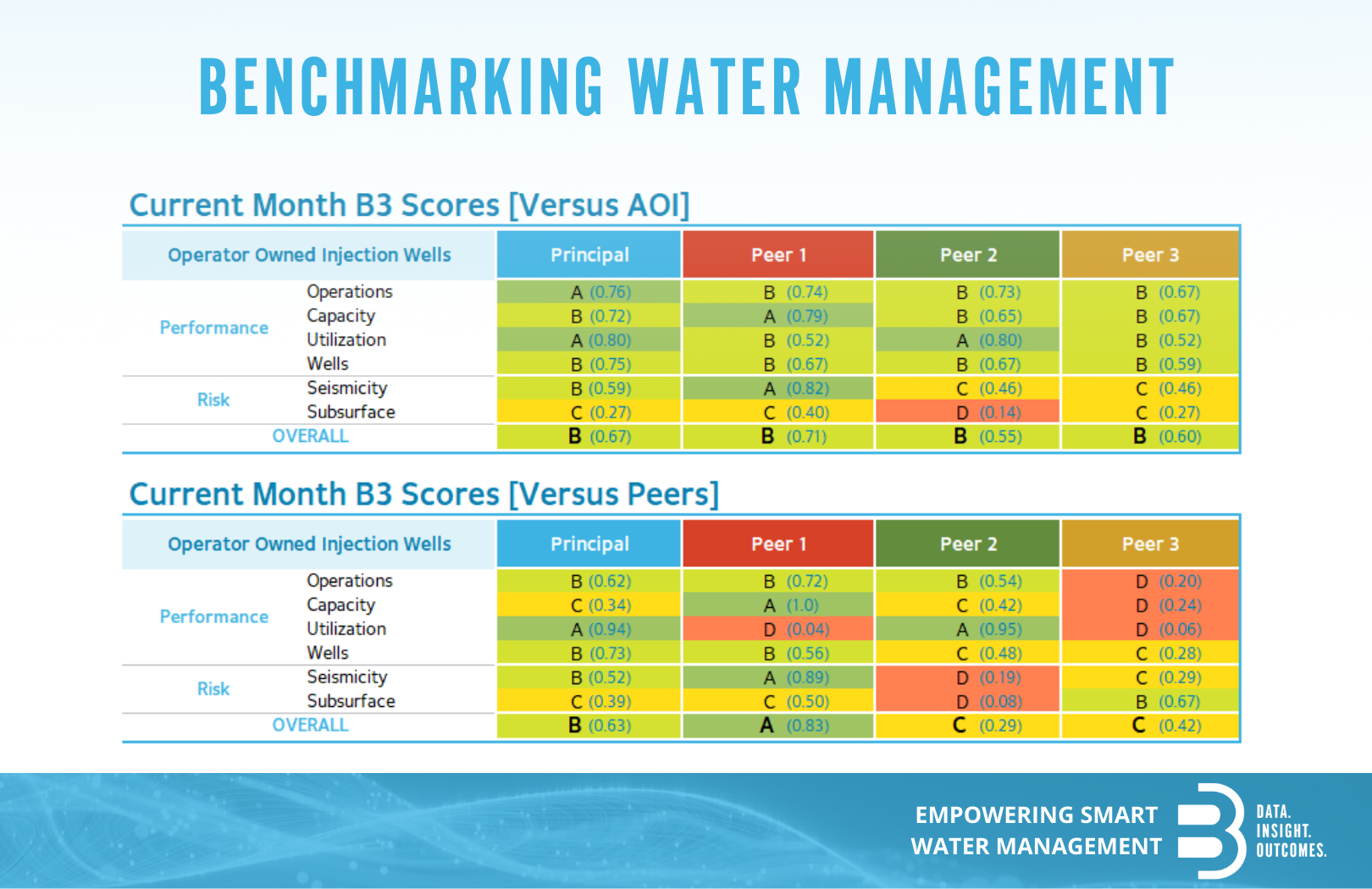

Efficient water management in the oil and gas industry can be a complex business and the best corporations and portfolio managers will use sector-focused data and market assessments to align their capital allocations with investor requirements and ESG goals. Industry-leading commodity management results in top rankings and maximizes revenues while also increasing environmental stewardship. Regularly evaluating your company’s efficiency in managing water assets will allow you to improve operational costs, track your (and others) trends and progress, document value, provide transparent benchmarking for capital opportunities, and gain key competitive advantages.

At B3 Insight we provide companies across the energy market the tools they need to better understand which key factors improve operational efficiencies and impact ESG initiatives.

With growing urgency around all things water, it’s time to know – are you just a 5.67?