By Kylie Wright

The buzz around “ESG” – short for “environmental, social, and governance” – has grown rapidly since its introduction in 2006 with a sharp increase beginning in early 2019[1]. But what exactly is ESG and how does it apply to the energy sector? In part one of this multi-part series from B3 Insight, we explore the fundamentals of ESG reporting and its use in the energy and water management sectors.

The Changing Face of Investment

There has been a dramatic change in the investment environment in the last decade due to a few key factors – the ubiquity of the internet and changing investor values, demographics, and spending power. The advent of no cost-trades and user-friendly apps that allow us to move sums of money around in mere seconds have given the average individual unprecedented access to the market. This shift in market access resulted in an influx of young, diverse, and socially conscientious investors who felt strongly that their values should be reflected in the companies they support[2]. Additionally, an intergenerational transfer of wealth to millennials is well underway, meaning their share of investment dollars is increasing and will soon surpass previous generations[3]. Large institutional funds are informed by the individuals that direct and comprise portfolios, so it makes sense that the increase in millennials’ socially conscious investment also increases the appetite of the largest firms for sustainable investments. Now, at all levels of investment, the market is increasingly looking for companies and industries that are responsible stewards of the environment, ethical operators, and supportive of individuals and communities. To establish their performance in these foundational areas, companies have begun to report ESG criteria[4].

The Evolution of “Responsible” Reporting

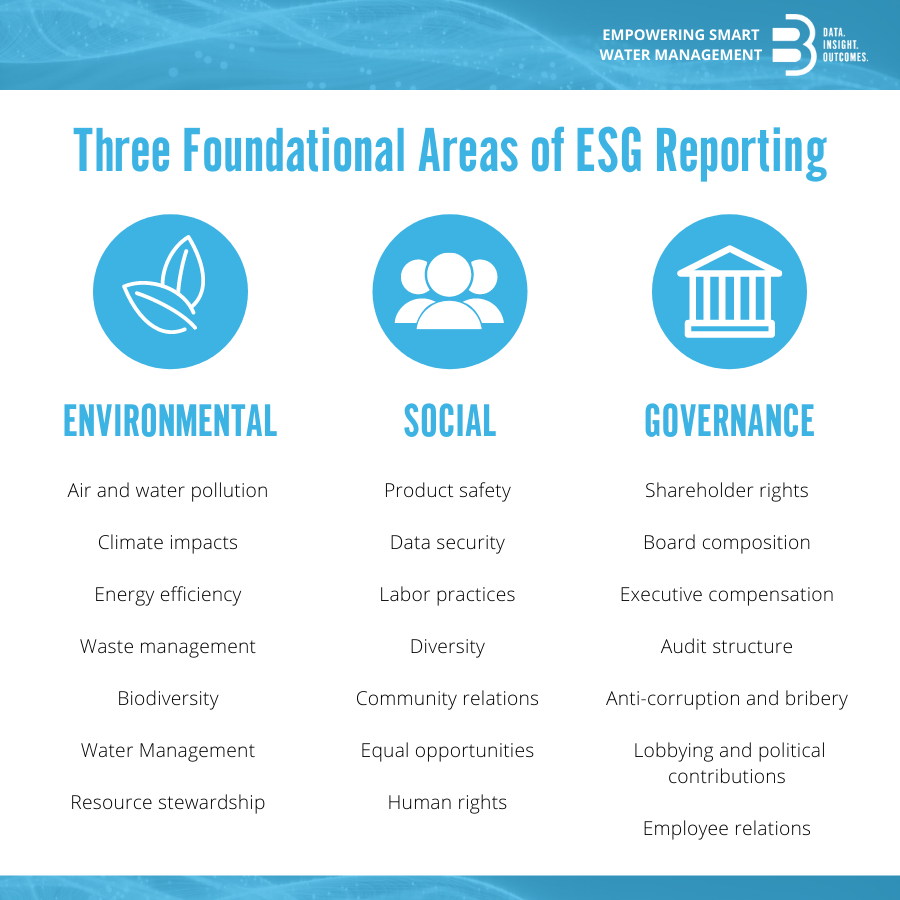

Prior to ESG reporting, these investors used “socially responsible investing”, a market methodology that has been around for decades if not hundreds of years[5], or “sustainable investing”, a mix-and-match approach of traditional and socially responsible investing strategies. ESG investing differs from traditional value-based investments as it is built on companies’ performance on non-financial, but financially material, criteria. This strategy, unlike the ones before it, focuses on commensurate levels of return with traditional investment strategies while ensuring responsible and ethical operations. When applied properly, ESG metrics are industry- specific and provide a framework for companies to disclose their current performance and goals associated with each of the three foundational areas. Environmental metrics review the company’s conservation of natural resources and include a review of climate impacts, air and water pollution, energy efficiency, waste management, and biodiversity. Social metrics focus on the company’s consideration of people and typically include product safety, data security, labor practices, diversity, and community relations. Governance criteria are concerned with ethical operating standards and include board composition, corruption, executive compensation, lobbying and political contributions, and audit structure.

Gone are the days of “feel good” reporting of company values and poorly defined sustainability practices that do not represent the reality of an organization’s commitment to responsible operations and management. To accurately inform investors and share a company’s ESG story, today’s disclosures must be reliably tracked, measurable, and quantifiable. Beyond simply reviewing ESG metrics internally, investors are calling for a higher degree of transparency and data sharing from industries to inform competitive market benchmarking based on ESG performance. Many companies now present ESG material either along with their annual financial reporting or in a standalone sustainability or ESG report. These documents are used by financial analysts to assess the ESG related risks and opportunities of a company which improves fundamental financial analyses and investing decisions.

Energy, Water, and ESG

The energy industry has faced increasing levels of public scrutiny in recent decades. Public pressure to reduce environmental impacts, reduce costs, and maintain production have encouraged the industry to reevaluate its social and environmental license to operate. As part of this evolution, the energy industry has embraced ESG reporting to transparently convey goals and progress toward minimizing environmental impact and building social capital. Of particular importance to the energy industry is the E in ESG. Our industry has much to be aware of regarding environmental impacts, including climate impacts, pollution and habitat preservation, waste streams, and water management. Environmental metrics reported in the energy industry are predominantly climate- and air-related initiatives, though. Many of the other factors related to environmental impacts are minimally reported on or the related metrics are inconsistent and poorly captured.

Metrics related to water management have been among the least standardized metrics in oilfield ESG reporting[6]. Water has traditionally been considered a waste stream in the energy industry and, as such, has not been meticulously tracked. Only recently has it demanded increasing attention due to droughts, municipal and agricultural water shortages, and the emergence of the oilfield water management industry related to the increase in tight-oil production. The lack of standardization of water-related metrics means that a key aspect of environmentally responsible operation is largely incomparable between energy companies. Because water management practices impact the environment, operations, supply chains, reputation, and safety, they represent material financial and operational risks for future success. Managing risk associated with water in the energy industry is crucial for protecting business viability, financial investments, and stakeholder relationships. In the subsequent articles within this series, we will explore the challenges and opportunities within water-related ESG reporting for the energy industry.

[1] https://trends.google.com/trends/explore?date=all&geo=US&q=ESG

[2] According to a 2019 survey and report by Morgan Stanley, millennials are twice as likely as other generations to invest in companies with significant positive social or environmental impacts.

[3] https://www.iisd.org/system/files/publications/sustainable-investing.pdf

[4] https://corpgov.law.harvard.edu/2017/07/27/esg-reports-and-ratings-what-they-are-why-they-matter/

[5] https://www.jstor.org/stable/25074988 https://www.jstor.org/stable/25074988

[6] R.G. Bruant, K. Bennett, S. Fox, S. Willard, and A. Michel. URTeC 2021. https://urtec.org/2021/Program/Technical-Program/Monday-Program.