Samantha Fox

Product Manager - Data and Consulting

Acronyms, abbreviations, and industry terms run rampant at B3 Insight. We talk about RRC, UIC, SWD, H-10, DUC and the list goes on. But, our conversations around produced water challenges have been dominated over the last few months by one in particular – P-18.

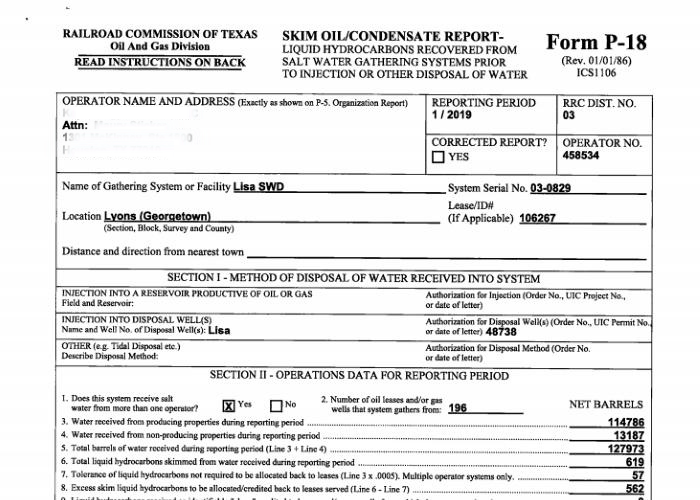

“P-18” is a Skim Oil/Condensate Report filed with the Texas Railroad Commission (RRC). P-18 Reports are filed by salt water disposal well (SWD) operators each month and records the amount of oil they skimmed from the produced water they gathered at each facility. The produced water volume from each lease is also reported on the form.

Why do we care about P-18 Reports?

Unlike many other states, Texas does not require monthly water production to be reported. Because produced water volume is not reported in Texas, the volume reported on the P-18 forms is very valuable.

While the intended purpose of the P-18 Report is to identify hydrocarbons recovered from SWDs, by necessity, it requires facility operators to report the amount of produced water received by the facility down to a lease level. The P-18 data provides a clear picture of the amount of water gathered at an SWD, by producer, and from what lease.

While this data is reported to RRC monthly, historically, it has only been publicly accessible as paper, scanned documents, requiring data consumers to tediously scour and transcribe thousands of PDFs to perform any kind of comparative or regional analysis. Less than ideal!

B3 has perfected a proprietary data digitization process, by which we’ve created digital data for hundreds of thousands of rows of P-18 produced water data, matched to SWDs. This data enables users to analyze and understand facility-specific and regional trends in water production and disposal operations and can visualize the ‘flow’ of where water is produced and where it goes to get disposed.

B3 customers are leveraging this data for strategic planning, project execution, and market development. E&Ps are discovering new ways to maximize water management efficiencies. Service and water midstream groups have new competitive insight into regional market penetration by disposal operators and commercial arrangements on specific facilities. We’re also seeing growth among the capital groups financing the oilfield water industry. Private equity investors can quickly evaluate both risk and opportunity on disposal assets, or on operators, based on their produced water takeaway capacity.

Our goal with this process around P-18 reports is to support companies addressing produced water constraints with a comprehensive and data-driven view of industry activity. The scale of the produced water challenge will prohibit isolated, single-operator solutions, and will require industry collaboration. Meaningful collaboration, in turn, will demand a reliable base of knowledge and information. P-18 data fills a critical gap in this information base, and will therefore, play an important role in any meaningful solution.around