By Kylie Wright

In the 19th and early 20th centuries, agriculture largely relied upon nitrogen fertilizer sourced from bird guano collected from “guano islands.1 ” As industrial agriculture became endemic to the modern world, the demand for nitrogen fertilizers increased dramatically, outstripping the available supply of guano. To resolve the supply shortfall, German chemists developed a method to affix atmospheric nitrogen (N2 ) with hydrogen (H2 ) to produce ammonia, the key ingredient in nitrogen fertilizers (NH3 ).2 Historically, technological evolutions or anticipated supply shortfalls have had a way of driving innovation.

Fast forward to this moment, right now. You’re almost certainly reading this article on a device made possible by rare earth elements (REEs) and “tech metals” like cobalt, lithium, cerium, or dysprosium. These key elements are the fundamental building blocks of modern technology and demand for them has increased exponentially in the preceding years. Supply shortfalls related to increasing demand are already impacting some markets, and significant supply gaps are anticipated within the decade. But what if the supply shortfall could be addressed by extracting these valuable elements from alternative sources? What if we could achieve a kind of alchemy by mining valuable metals from water?3

Produced Water: Waste or Resource?

“Produced water” refers to the water that emerges from a petroleum production well alongside the oil or gas. Produced water is not simply spring water gushing forth from the ground but is comprised of formation water and production fluid and includes (sometimes copious) amounts of hydrocarbons, suspended and dissolved solids, organic material, naturally occurring radioactive material, and production chemicals.4 The exact composition of produced water depends on many factors, including the location, type, and age of the geological formation it is extracted from or interacts with. Elements or compounds commonly found at varying concentrations in produced water include sodium, calcium, magnesium, lithium, sulfates, and carbonates, among others.5 Produced water is commonly treated to extract this material to ensure the water is suitable for reuse, disposal, or discharge, the three most common management options. Some creative scientists are developing methods to extract valuable resources in economic quantities from produced water to make the most of the treatment phase.

Mining Materials from Produced Water

Mining materials from produced water has been frequently discussed as an interesting avenue to sustainably leverage an existing waste product and offset the cost of produced water management. The primary constraints limiting materials extraction from produced water are concentration, technology, and economics, which together determine the feasibility of “mining” produced water. For example, salt extraction is a regular part of water treatment workflows with numerous established technologies able to readily remove large volumes of salts (KCl, MgCl2, NaCl, etc.) from produced water. There are even some existing facilities which already support the extraction and sale of salt from produced water.6 Unfortunately, salts are not high-priced commodities and are only saleable in particular markets (i.e., the icy northeastern United States) which renders salt mining a modest opportunity. Another potential opportunity lies in REE extraction from produced water, but REE concentrations are limited to trace amounts in produced water, and development of economic extraction methods is an ongoing area of research.7 The most significant opportunity arguably lies in lithium.Lithium: The Energy Storage Revolution

Lithium is a key resource in the production of batteries used in electric vehicles (EVs), smartphones, and laptops.8 Global lithium resources are predominantly concentrated in the “Lithium Triangle” of Latin America: Bolivia (21 million tons [Mt9 ] ), Argentina (19 Mt), and Chile (10 Mt).10 However, mining of lithium primarily occurs in Australia (40 thousand tons [mt]), Chile (18 mt), China (14 mt), and Argentina (6.2 mt), in part because of infrastructure constraints elsewhere.11 Bolivia has not yet been able to produce lithium in commercial quantities, seriously hampering global lithium supplies.12 Current projections estimate that global lithium demand will outstrip probable supply within the decade as the EV and battery-tech revolution continues. Anticipated supply shortfalls will likely be due to a lack of investment in new production, the time-consuming process of opening new mines (~7-10 years), and the inability of crucial resource holders to accelerate resource development.13 Recent studies of the potential lithium shortfall have tapped new lithium sources, including oilfield brines and produced water, as key to bridging the supply gap.14 15

The increasing demand for lithium is easily visible in recent, dramatic price increases. Spot lithium carbonate prices in China, the primary lithium market, were about $75,000 per metric ton as of March 2022, representing an almost a 550% annual increase. Lithium hydroxide prices exceeded $65,000 per metric ton in 2022 compared with a five-year average of $14,500 per metric ton.16 Lithium hydroxide and lithium carbonate are the two primary compounds sold on the market and the difference between the two is relevant (and further described in the Notes) (Figure 1).17 The life cycle for each compound is different in process, expense, length, and end-use. The two primary lithium-ion battery cathodes widely available on the market are lithium iron phosphate (LFP) and lithium nickel-manganese-cobalt (NMC). NMC batteries pack a higher energy density and require lithium hydroxide while LFP batteries can use lithium carbonate and have more stable chemistry leading to a longer life span.18 The market has historically favored LFP but there is a recent market push toward NMC batteries, adding to the demand for multiple new sources of lithium.19

An Electric Car in Every Pot

EV sales are slated to increase by almost 40% from 2021 to 2022, driving the price and demand for lithium up with no end in sight.20 Some estimates indicate that you need about 60,000 tons of lithium carbonate to build one million EVs, while multiple reports, including the IEA and Tesla founder Elon Musk, have stated the global EV market will approach approximately 30 million EVs by 2030.21 22 23 24 This number of EVs would require about 1.4 million tons of lithium carbonate. According to the USGS, the world produced only 82,000 tons of lithium carbonate in 2020.25 Clearly, one of those numbers is not like the other.

Mining Lithium from Produced water

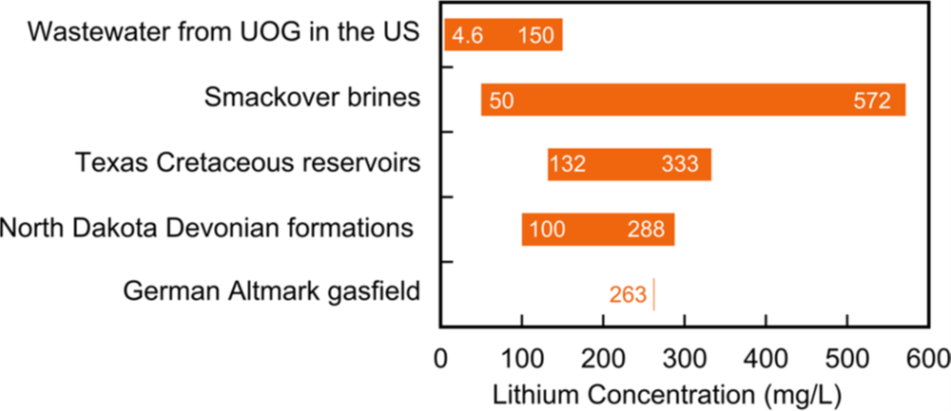

Lithium concentrations in produced water typically need to be over at least 100 mg/L to make recovery feasible. Participants in recent industry conversations have stated that brines with low lithium concentrations would only be usable if saturated26 to increase the lithium concentrations. This process also increases the concentration of other materials in the water (e.g., salt or heavy metals) which complicates and impede the success of the extraction chemistry.27 Nevertheless, multiple projects are moving forward to determine the feasibility of recovering resources from produced water and brine in multiple basins. One oilfield water resource of keen interest is the Smackover Formation brine in the East Texas-ArkLa Basin which can be over 500 mg/L lithium (Figure 2).28

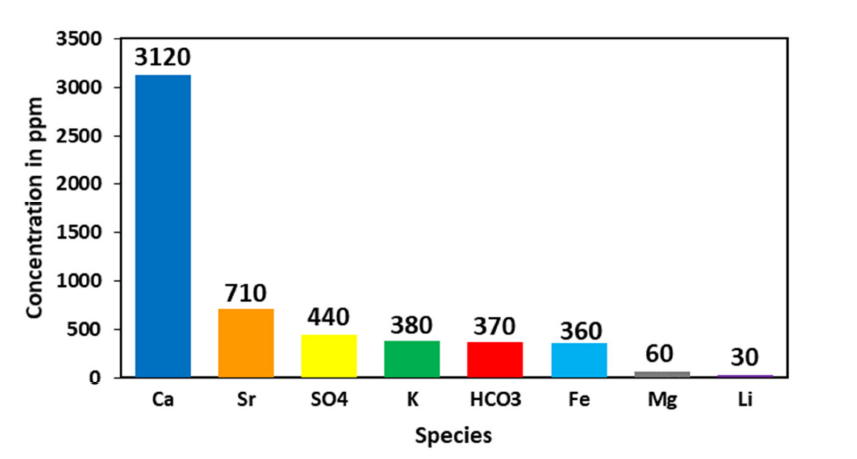

There are likely numerous oilfields that produce water with lithium concentrations high enough to allow economic recovery. Some estimates indicate that across multiple producing basins, the available produced water (and oilfield brine) lithium resource is hundreds of metric tonnes of lithium metal equivalent.29 The Permian Basin, the most prolific United States oil and gas basin, generates billions of barrels of produced water every year, but most water has a relatively low lithium concentration (Figure 3).30 Permian produced water would need to be processed to increase the saturation of lithium but highly salinity brines, as previously stated, do not play well with extraction chemistry. Mining Permian produced water will therefore be contingent on the development of new technologies to improve the economics.

Technology and alchemy

The dramatic increase in lithium and REE prices over the past few years may have made previously uneconomic recovery methods possible, encouraging the development of new recovery technologies.31 There are currently four major classes of lithium extraction technology: adsorbents, membrane-based separation, solvent extraction, and electrolysis-based systems. Although well established as a treatment technology in the oilfield, membrane surfaces can foul easily and can make recovery of lithium more challenging and less economic, though some operators are reporting success.32 New adsorption materials and membranes are currently being developed to recover lithium more selectively, but many of these technologies are still evolving.33 34 Phosphate precipitation is a recently developed technique that aids in the solar evaporation of lithium rich brines but is only applicable to brines with high lithium concentrations. When it comes down to it, the most likely evolution of lithium extraction from produced water will be the development of treatment-trains or processes which combine multiple treatment methods. This may increase the cost of the extraction but could be feasible in a sustained high commodity price environment.

An encouraging factor of produced water “mining” is that this potential resource will not require virgin resource extraction like new hard rock mining or drilling new wells to retrieve brine. Produced water is brought to the surface as part of an existing resource extraction process, so the initial investment in developing the raw resource is completed and paid for by an existing industry. With huge volumes of produced water available to leverage across the world due to the shale revolution combined with historically high commodity prices, there is clearly an opportunity to leverage produced water as a resource for valuable materials. To summarize the details of this opportunity:

- The booming technology sector has increased the demand for and prices of many elements including lithium, cobalt, and REEs.

- Lithium in particular is slated to experience a supply shortfall within the decade unless the world develops new lithium sources outside of traditional mining or brings multiple new mines online in a very short time frame.

- Produced water and oilfield brines contain lithium and other valuable materials, some in high enough quantities to be resources. Producers in some regions are already extracting materials like salt and lithium from produced water for sale with success.

- Technology exists and is developing to enhance lithium extraction but depending on the water resource, extraction may require a sequence of expensive technologies to recover useful amounts of lithium.

- A sustained high commodity price and high demand environment will make lithium (and REE) recovery more feasible from already extracted resources like produced water.

Empowering Smart Water Management

B3 Insight is building the definitive source for water data. We empower smart water management with data-driven intelligence for responsible and profitable decisions about water resources. Whatever your needs, B3 Insight’s OilfieldH2O can positively impact your water management and drilling completions – contact us at [email protected] or 720-664-8517 to learn more.

notes

- Islands where a large number of sea birds congregate and defecate creating massive deposits of nitrogen rich bird droppings.

- The Alchemy of Air. Thomas Hager. Crown Books. 2008.

- Technically, mining metals from water is already a thing. One of the major lithium extraction processes and a traditional method of mining many materials, is solar evaporation from mineral rich brines, but bear with me on the poetic nature of this question.

- AGI. 2022. “What is produced water?” https://www.americangeosciences.org/critical-issues/faq/what-produced-water.

- Water. 2022. Miranda, et al. “Treatment and Recovery of High-Value Elements from Produced Water” https://www.mdpi.com/2073-4441/14/6/880.

- Journal of Petroleum Technology. 2017. “Turning dirty produced water into fresh water and salt to sell.” https://jpt.spe.org/turning-dirty-produced-water-fresh-water-and-salt-sell.

- Quillinan, S. et al. US Department of Energy, Geothermal Technologies Office Report. Assessing rare earth element concentrations in geothermal and oil and gas produced waters: A potential domestic source of strategic mineral commodities. https://www.osti.gov/biblio/1509037-assessing-rare-earth-element-concentrations-geothermal-oil-gas-produced-waters-potential-domestic-source-strategic-mineral-commodities-final-report.

- Visual Capitalist. 2021. “Lithium: The Key Ingredient Powering Today’s Technology.” https://www.visualcapitalist.com/lithium-key-ingredient-powering-todays-technology/.

- Million tons of estimated lithium resources defined as “a concentration of naturally occurring material in such form and amount that economic extraction of a commodity from the concentration is currently or potentially feasible.”

- USGS. 2021. Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021.pdf.

- Thousand tons of estimated lithium production from active mines or evaporation sites.

- Wilson Center. 2022. “Can Bolivia Jump-Start its Lithium Production.” https://www.wilsoncenter.org/blog-post/can-bolivia-jump-start-its-lithium-industry-qa-analyst-juan-carlos-zuleta#:~:text=Bolivia%20is%20home%20to%20the,to%20the%20U.S.%20Geological%20Survey.

- S&P Global. 2022. “Insufficient lithium supply could decelerate energy transition.” https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/metals/012622-infographic-the-lithium-deficit-road-map-will-future-supply-meet-demand.

- Mckinsey. 2022. “Lithium Mining: How new production technologies could fueld the global EV revolution.” https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution?cid=other-eml-alt-mip-mck&hdpid=38381910-b010-4f9b-a709-83f29f80c3d7&hctky=10577176&hlkid=4afb87ed44e24b75a7649eedbea2e60d.

- Kumar, A. et al. ACS Energy Letters. 2019. “Lithium Recovery from Oil and Gas Produced Water: A Need for a Growing Energy Industry.” https://pubs.acs.org/doi/10.1021/acsenergylett.9b00779.

- Mckinsey. 2022. “Lithium Mining: How new production technologies could fueld the global EV revolution.” https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-mining-how-new-production-technologies-could-fuel-the-global-ev-revolution?cid=other-eml-alt-mip-mck&hdpid=38381910-b010-4f9b-a709-83f29f80c3d7&hctky=10577176&hlkid=4afb87ed44e24b75a7649eedbea2e60d.

- To get a higher energy density, manufacturers must use nickel-compound based cathodes. Lithium hydroxide decomposes at a lower temperature than lithium carbonate. The chemistry of the nickel compounds becomes unstable at high temperatures and synthesizing cathode material using lithium carbonate requires higher decomposition temperatures than lithium hydroxide. Lithium hydroxide is therefore the preferred material in battery manufacturing but is more costly to extract than lithium carbonate which can be precipitated directly from concentrated brines using time-consuming but cheap solar evaporation.

- IHI Terrasun Solutions. “The NMC vs. LFP Question.” https://www.ihiterrasun.com/charged-choices-the-lfp-vs-nmc-question/.

- Bisley International. 2021. “What is the difference between lithium carbonate and lithium hydroxide?” https://bisleyinternational.com/what-is-the-difference-between-lithium-carbonate-lithium-hydroxide/#:~:text=Lithium%20hydroxide%20is%20a%20lithium,product%20to%20be%20long%20lasting.

- Forbes. 2022. “EV Sales soar as variety and gas prices climb, study finds.” https://www.forbes.com/wheels/news/ev-sales-soar-in-2022/.

- Barrons. Al Root. 2020. “Why lithium could be a new risk for Tesla and other electric-vehicle makers.” https://www.barrons.com/articles/new-risk-tesla-other-electric-vehicle-makers-lithium-supply-batteries-51601498472.

- Elon Musk. Twitter. 2020. https://twitter.com/elonmusk/status/1310485091920084992?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1310485091920084992%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.barrons.com%2Farticles%2Fnew-risk-tesla-other-electric-vehicle-makers-lithium-supply-batteries-51601498472.

- IEA. 2021. “Global EV Outlook 2021.” https://www.iea.org/reports/global-ev-outlook-2021/prospects-for-electric-vehicle-deployment.

- IEA. 2021. “Electric Vehicles.” https://www.iea.org/reports/electric-vehicles.

- USGS. 2021. Mineral Commodity Summaries. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021.pdf.

- Processing (can be evaporation) the water to a point where the total dissolved solids and other dissolved constituents in the water are concentrated to a point of chemical saturation. Saturation indicates the degree to which something is dissolved or absorbed into a solution compared to the maximum possible.

- Personal communication during Project PARETO stakeholder call. March 2, 2022.

- Kumar, A. et al. ACS Energy Letters. 2019. “Lithium Recovery from Oil and Gas Produced Water: A Need for a Growing Energy Industry.” https://pubs.acs.org/doi/10.1021/acsenergylett.9b00779.

- Kumar, A. et al. ACS Energy Letters. 2019. “Lithium Recovery from Oil and Gas Produced Water: A Need for a Growing Energy Industry.” https://pubs.acs.org/doi/10.1021/acsenergylett.9b00779.

- Miranda, M.A., et al. 2021. Water. “Treatment and recovery of high-value elements from produced water.” https://www.mdpi.com/2073-4441/14/6/880.

- Nikkei Asia. 2021. “Tech industry braces for skyrocketing rare earth prices.” https://asia.nikkei.com/Business/Technology/Tech-industry-braces-for-skyrocketing-rare-earth-prices.

- Produced Water Society. 2021. “Are thermal technologies what the Permian Basin needs?” https://producedwatersociety.com/are-thermal-technologies-what-the-permian-basin-needs/.

- Warnock, S. J., et al. 2020. PNAS. Engineering Li/Na selectivity in 12-crown-4-functionalized polymer membranes. https://www.pnas.org/doi/10.1073/pnas.2022197118.

- Miranda, M.A., et al. 2021. Water. “Treatment and recovery of high-value elements from produced water.” https://www.mdpi.com/2073-4441/14/6/880.

- Kumar, A. et al. ACS Energy Letters. 2019. “Lithium Recovery from Oil and Gas Produced Water: A Need for a Growing Energy Industry.” https://pubs.acs.org/doi/10.1021/acsenergylett.9b00779.